written by MEC’s Buildings Department program manager, Mary English

One of the things I love about my profession is the fact that I learn new things regularly. My most recent new learning was inspired by the expression “April through October Houses” during an informative and entertaining radio interview with the host of Cowtown Conversations, Joseph Jackson, on his KKFI 90.1 FM show. He spoke this phrase in reference to homes in Kansas City that may be rented to tenants in the spring, only to have the leases broken when autumn’s chill settles into the air and the homes become too cold to inhabit.

The topic deserving of Joseph’s surprising reference was easy building performance and home weatherization tips that anyone can handle. In light of my own epiphany about a previously unconsidered perspective, I’d like to expand on a few statements from that interview that we didn’t have time to cover. I feel that knowing these things about the task of making a building more energy efficient would help even the most cash-crunched households achieve warmer homes and better health.

1 “April through October” conjures thoughts of beautiful spring and fall colors—not to mention nicer weather—sandwiching the summer months of what can be oppressive heat in the Kansas City region. So when Joseph alerted me to an expression that is in among renter vernacular, all I could think was, “If these homes are so uncomfortable that the occupants have to live elsewhere in the winter, they also must be enduring some serious discomfort in June-August as well.” As I’ve been witness to many homes in need of repair and energy upgrades in a former life as a home energy auditor this is not a surprising revelation.

During the interview, we discussed home weatherization and tips for residents that have the money and authority to weatherize. But for renters, the weatherization task gets more difficult since renters don’t own their homes. The problem can be viewed as systemic—renters understand both the discomfort of an extreme indoor temperature and in most cases, the pain of a high utility bill that results when they try to return the home to livable temperatures. If the landlord is not empathetic or receptive to making energy upgrades for their renters? Voila: the April through October House has been enabled by an inequitable system of utilities being paid directly by tenants.

Ethical and moral considerations aside, if only this class of landlord realized this key truth about building management, the April through October Home would likely evaporate: An efficient home leads to a better bottom line because it keeps renters who want to stay, instead of forcing them out due to unbearable discomfort. Energy efficiency upgrades don’t cost in the long run. They pay landlords back. The National Apartment Association estimates that high turnover can consume up to 9% of gross rental income for larger multi-family residences, so landlords would come out on top, if only their renters could continue living in the buildings.

For those people reading who do own their homes—and pay their own utility bills—the return on investment for home energy efficiency upgrades is better than most financial products. Plus, we are not even addressing the healthcare costs endured due to medical problems caused by inefficient homes.

Anyway, if I could wave a magic wand, I’d make all landlords cover the cost of utilities for tenants in their rent. This would incentivize the building owners to actually make improvements on their “April to October” buildings. Then they might want to actually make their properties as efficient as possible to save money, and realize lower turnover rates as well. Happy renters and wealthier properties owners: I’d call that a win-win.

2 Speaking of weatherization, Joseph came prepared to talk about building improvements. In addition to his extensive experience doing his own energy retrofits, he had prepared a well-researched list to share with the program’s listeners. Things like caulking around windows, adding weather-stripping, and sealing the seams of exposed ductwork were all included and endorsed by yours truly.

One more improvement on the laundry list, though, is adding window weatherization plastic to the interior window frame ahead of the heating season. In the interview, I did not get a chance to say, “If you add plastic to your windows, make sure you remove it in the spring.” This unvoiced sentence has been bothering me since the interview.

Here is why: If you leave the plastic in place for the summer months, you may be inviting mold and eventually wood rot on any window trim or sill sealed in behind the plastic. (Perhaps you don’t open your windows ever and don’t think about it.)

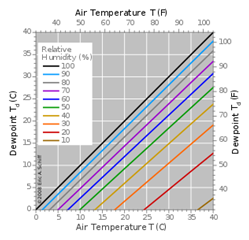

How does this mold and wood rot happen? Well, it has to do with extreme temperature change between the hot and humid summer air outside, and the cool, conditioned air in the house, on the interior side of the plastic. In Kansas City, we get very high humidity which creates a dew point as low as your thermostat setting for a typical central air-conditioned house. That air hits sealed cold plastic around your windows and boom: condensation. Next comes the spores and then the mold growth.

So, remove that window weatherization plastic in the spring for health and durability’s sake.

3This gets me to our conversation regarding professional energy auditors. The happy news is that there are low-cost audits to be had. In the interview, Joseph mentioned that he had received an energy audit for $35.00 by using Groupon. So I “Googled it” and there are indeed deals for Kansas City residents to get energy audits for that low of a price (or even lower) currently using online coupon services like Groupon.

These deals are advertising use of thermal imaging from one vendor, and another advertises “air leakage” testing. However, it is unclear to me if these deals reflect a product that is a full-scale comprehensive energy audit that includes a blower door test with a detailed infrared scan and carbon monoxide safety testing which is how I define “home energy audit.” To review or explain further, a full-scale home energy audit should take roughly two hours minimum – longer for larger houses – and include:

- An infiltration test of the whole house using a Blower Door.

- Thermal imaging once the testing is done with the Blower Door still operating to create a situation where a thermal camera can visually detect air leaks.

- A natural gas line test; and carbon monoxide testing of all gas-burning appliances.

- A report that shows images and gives an executive summary of recommendations with an estimated payback should these recommendations be executed by a contractor or homeowner.

Doing a bit more research regarding the market surrounding home energy audits led to me to realize that the industry looks a little differently than when I was regularly conducting energy audits for homeowners and contractors. Gone are the days where a consultant could offer the audit as a stand-alone product as the industry has adjusted to a loss of subsidized incentives. There are companies that do stand-alone auditing still, but most now are offering low or no-cost energy audits as what is called a “loss leader” product. In other words, the company offers audits as a lead into their other services of insulating your attic and walls, for example.

These professionals may be doing a thorough job of auditing your home, but if the end goal is to get you to buy their other products, what do you think their audit reports are going to be concentrating on for their list of to-dos? I am a big proponent of adding insulation, but the safety and blower door testing are important to make sure these upgrades are being done safely and correctly.

To reiterate, the change reflects the loss of subsidies from regional utility programs as well as robust tax breaks on the federal level to help homeowners pay for these services. Hopefully, that will be rectified by the current administration’s proposed Build Back Better program which is currently making its way through Congress and has $500 million set aside for home energy upgrades and contractor training. Homeowners, contractors, and the energy professional industry would be helped immensely by more subsidies, since it’s clear that most folks aren’t interested in paying $300+ out of pocket for a professional consultant to conduct a full-scale home energy audit.

And as I’ve stated multiple times including a previous blog on this website, this is not just about efficiency—this is also related to the health of building occupants. Building efficiency is related to human health. Period. And since America loves to brag about the American Dream of a “home sweet home,” it’s important that our homes are truly shelters from the elements, and safe from indoor pathogens as well.

Though sparse, there are some resources currently. These are:

- A federal tax credit of up to $500 for energy auditing and to subsidize added insulation, efficient windows, doors and skylights. (Receipts must be shown and it covers a small percentage of the cost incurred.)

- Community Action Agency that offers weatherization services free of charge for low-income homeowners and renters. They have an application process that requires income and utility bill information. Please follow the link to their website for more information.

- And for alternative energy generation* a federal tax credit for installing “solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. The applicable percentages are:

- In the case of property placed in service after December 31, 2019, and before January 1, 2023, 26%.

- In the case of property placed in service after December 31, 2022, and before January 1, 2024, 22%.”

*Note: I will always argue that building owners must address energy-saving measures first prior to installing alternative energy generation. Otherwise, you’re just subsidizing waste; not to mention generation does not address inefficient attributes impacting your health and comfort.

MEC will be updating this on our website too as Build Back Better and utility companies ramp up more programs to help homeowners pay for upgrades. We are also here for you, renters and tenants, if you need us to answer any questions you may have concerning the efficiency of a building where you live. Please reach out – we’re just a phone call or email away.